FY23 HRSA 340B Audit Findings Summary

This newsletter covers 340B Drug Pricing Program (340B Program) updates.

Sep 9, 2024

September 2024

The Health Resources and Services Administration (HRSA) and Office of Pharmacy Affairs (OPA) is responsible for administering the 340B Drug Pricing Program (340B Program). HRSA has developed program integrity guiding principles to maximize 340B Program oversight and manage compliance risks. HRSA has increased its scrutiny over covered entity (CE) compliance with 340B regulations since the inception of periodic audits in 2012 and has consistently audited 200 entities each year since 2015. More than 2,000 audit results have been posted by HRSA since 2012. Below is a summary of the recent developments related to HRSA audit findings and a summary of HRSA FY23 audit results as of August 2024.

HRSA 340B program integrity audit news

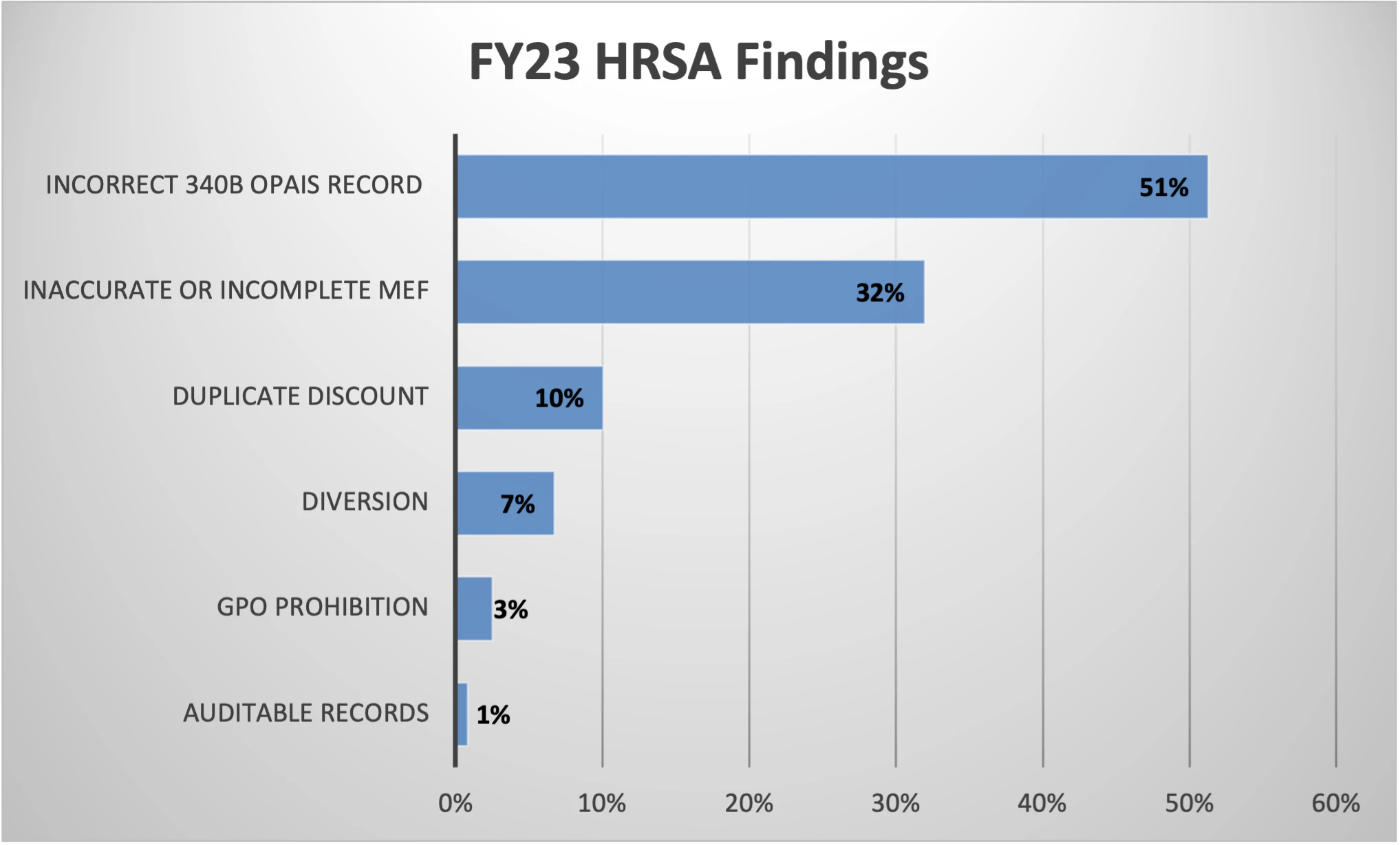

Beginning in FY21 and continuing in FY23, HRSA’s data request list included specified Medicaid fee-for-service (FFS) billing items including a list of the states billed, the corresponding billing numbers listed on the claims, the state’s requirements for billing 340B drugs, and a copy of a Medicaid FFS claim for each state billed. These new data request items demonstrate increased scrutiny by HRSA related to Medicaid FFS duplicate discount compliance. Audit findings related to duplicate discount compliance include Inaccurate or Incomplete Medicaid Exclusion File (MEF). This finding is used when it is determined that a duplicate discount did not occur and does not require repayment to the manufacturer. A Duplicate Discount finding is less common but does result in repayment to the manufacturer.

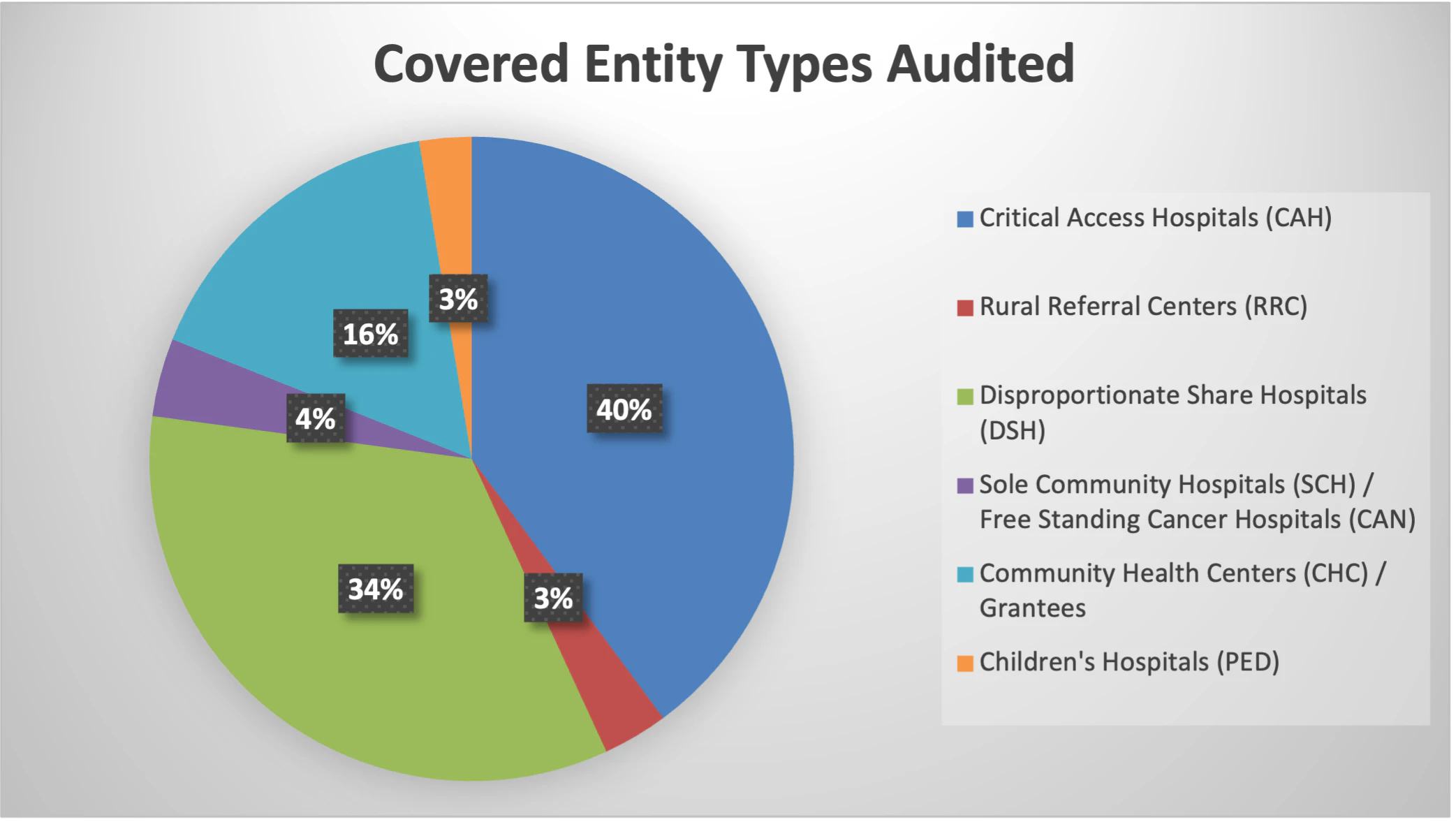

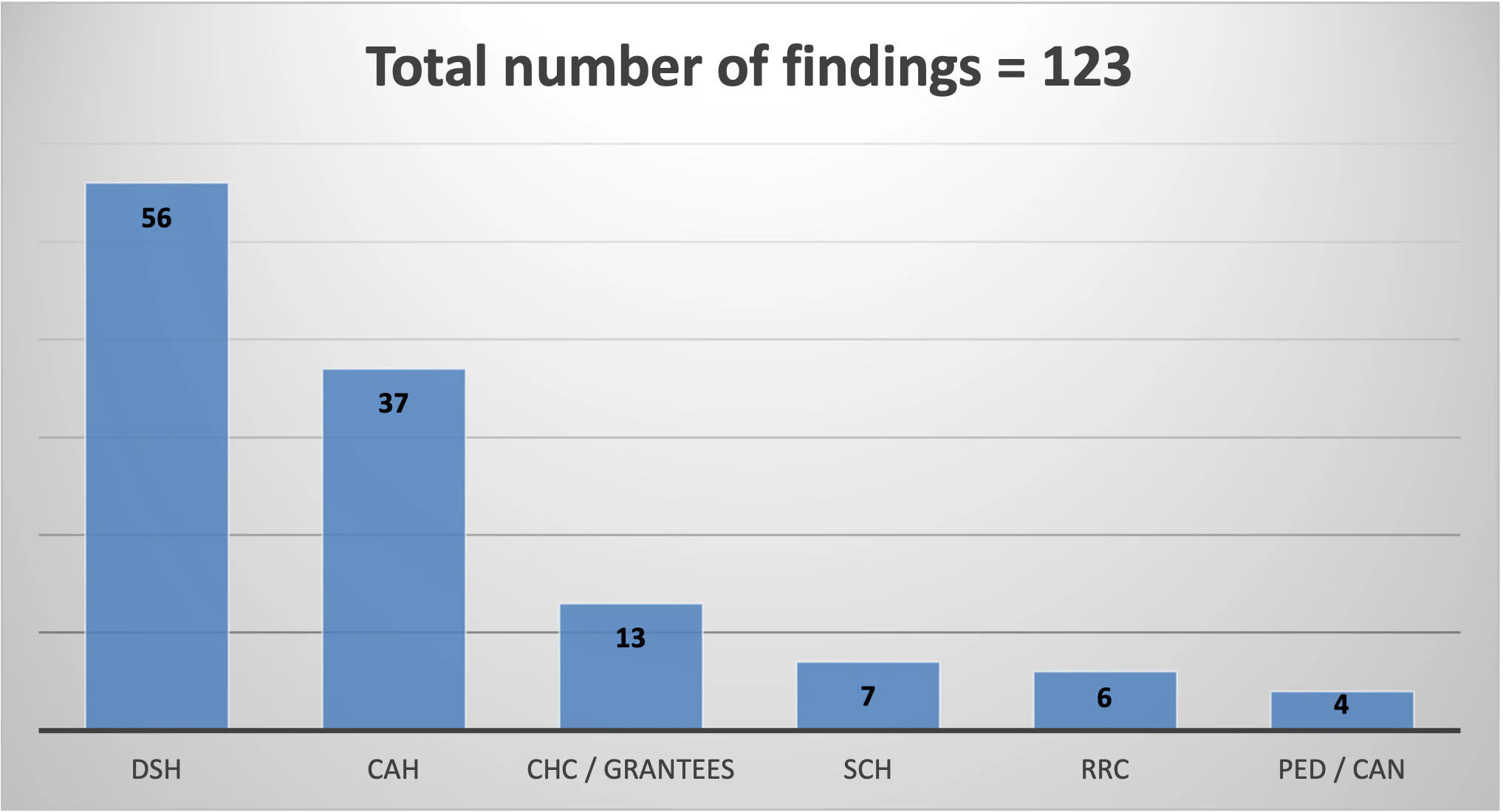

Due to the limited authority related to oversight of the 340B Program by HRSA, audit results have changed significantly in the past three years. While HRSA is staying consistent with choosing hospitals and healthcare facilities from a variety of states, Critical Access Hospitals (CAH) and Disproportionate Share Hospitals (DSH) make up the majority of the audits performed and the total number of findings. Grantees continue to be audited with similar frequency in FY23 compared to previous years. In addition, Inaccurate 340B OPAIS Record continues to be the top HRSA audit finding in FY23.

Summary of FY23 HRSA program integrity audits

HRSA last updated FY23 program integrity audit findings on their website on August 30, 2024. The results below reflect those from the audit results posted to date:

- 152 HRSA audit results have been posted from FY23, with 38% of the audits completed resulting in no adverse findings.

- CEs from 39 different states have been audited by HRSA in FY23.

- 83% of FY23 audits are hospitals; CAHs make up most of the covered entity type audited at 40%, followed by DSHs at 33%.

- Grantees including Community Health Centers (CH/CHC/FQHCLA), Ryan White HIV/AIDS Program Grantees (RW/HV), and Sexually Transmitted Disease Clinics (STD) make up 16% of the CEs audited in FY23.

- There are 123 audit findings currently posted for FY23 with Incorrect 340B OPAIS Record listed as the most common finding at 51%, which is consistent with FY22 audit findings. Inaccurate or Incomplete MEF is the second most common finding at 32%. Incorrect entry in 340B OPAIS for Medicare cost report filing date is the most common Inaccurate 340B OPAIS Record finding.

- 25% of audits require repayment to manufacturers due to a duplicate discount or diversion finding.

- 9% of audits require termination of contract pharmacies from the 340B Program due to an Incorrect 340B OPAIS Record finding.

- 5% of audits require termination of ineligible offsite outpatient facilities or grantee associated sites from the 340B Program due to an Incorrect 340B OPAIS Record finding.

Audit finding prevention strategies

- Prevent an Inaccurate 340B OPAIS Record finding by confirming contract pharmacy locations registered on OPAIS match the locations listed in the pharmacy service agreement, closed or terminated contract pharmacies are removed from OPAIS, only eligible sites are registered on OPAIS, duplicate registrations are removed, hospital control type is consistent with eligibility documents, Medicare Cost Report filing date and cost reporting period and EIN on OPAIS is accurate, and there is accurate physical and ship-to/bill-to address documentation on OPAIS for offsite outpatient facilities, grant associated sites, and entity owned pharmacies.

- To help prevent an Inaccurate MEF finding, add billing numbers to OPAIS for not only the CE’s “home” state but for each state you intend to bill Medicaid FFS for drugs purchased through the 340B Program. When the MEF is complete with the accurate billing numbers, National Provider Identifier (NPI) and Medicaid Provider Number (MPN), it will also aid in the prevention of a Duplicate Discount finding.

- Comply with all state Medicaid laws that mandate billing requirements for 340B purchased medications by developing a process to regularly review claims data from the parent and all child site locations where Medicaid is a primary, secondary or tertiary payor. This may include billing the drug ingredient cost and/or claim modifiers. States may also determine whether the Medicaid billing requirement includes 340B purchased medications billed to Medicaid Managed Care Organizations (MCO).

- For 340B eligible prescriptions, confirm there is documentation in the electronic medical record (EMR) that demonstrates the patient received services at the covered entity. The CE must own or have access to the EMR that documents care related to the eligible prescription.

- The leading cause of Diversion findings are related to 340B drugs being administered to inpatients. Work with your registration and IT teams to confirm the status of the patient (inpatient vs. outpatient) is accurately captured at the time of drug administration. The status of the patient at the time of drug administration is fundamental to determining 340B eligibility in the split-billing software. Status changes that affect 340B eligibility should be sent to the split-billing software on a real-time basis to confirm compliance with the 340B patient definition.

Want the latest updates from Kodiak?

Get access to our communications, including our Healthcare Connection newsletter, to tap into industry trends, CPE webinars, and more.